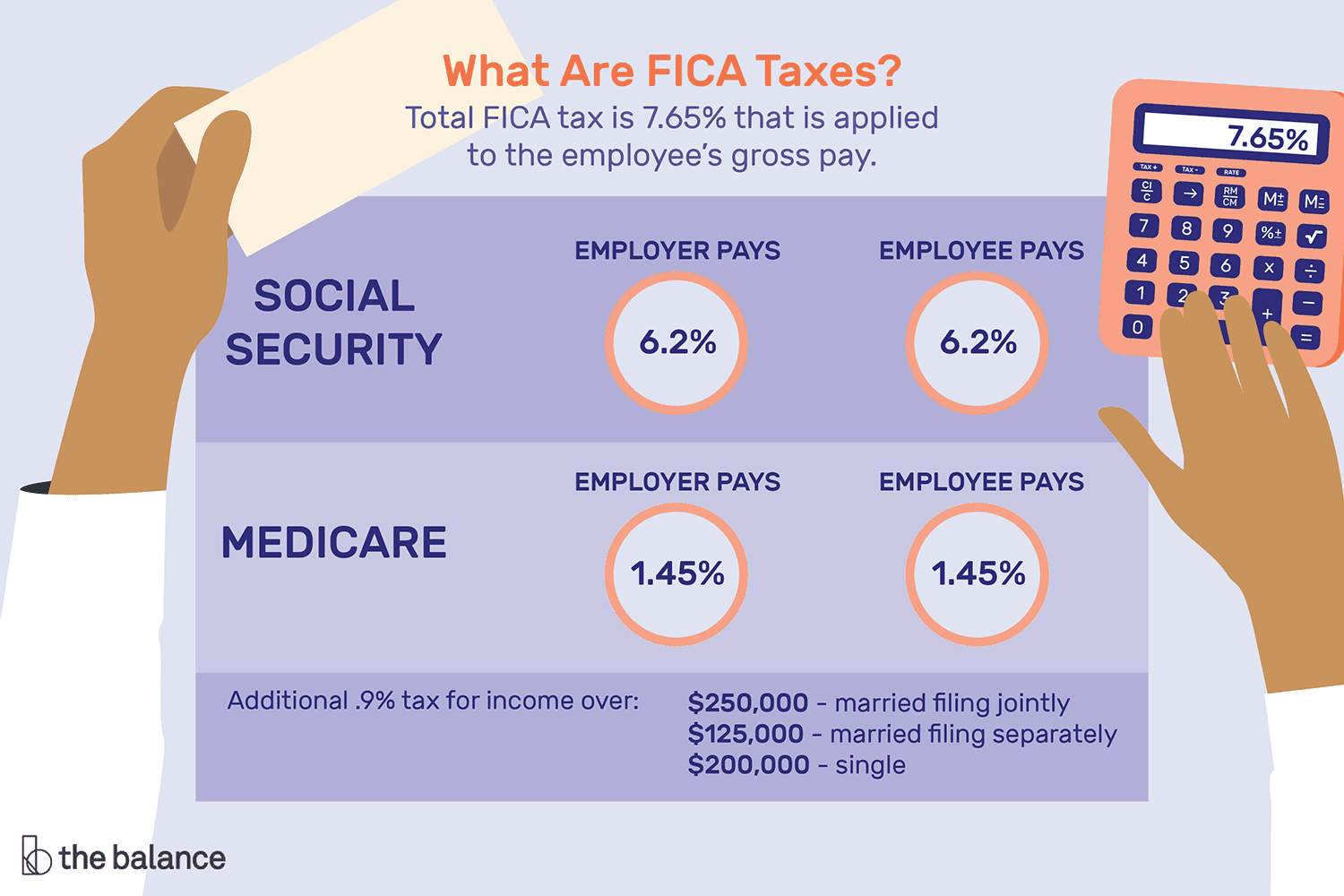

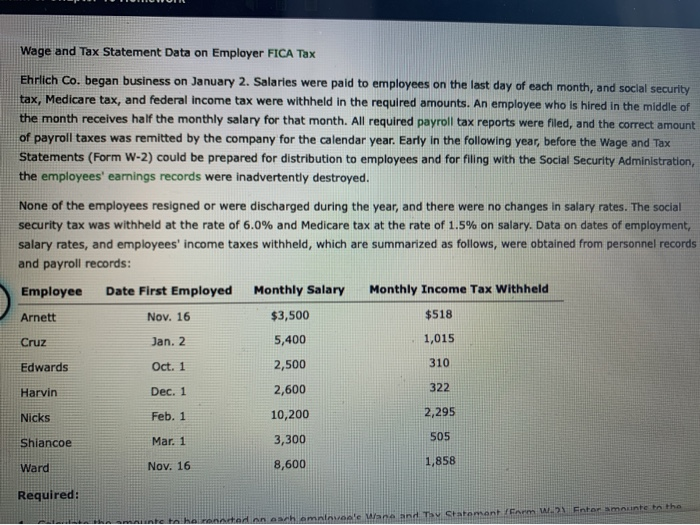

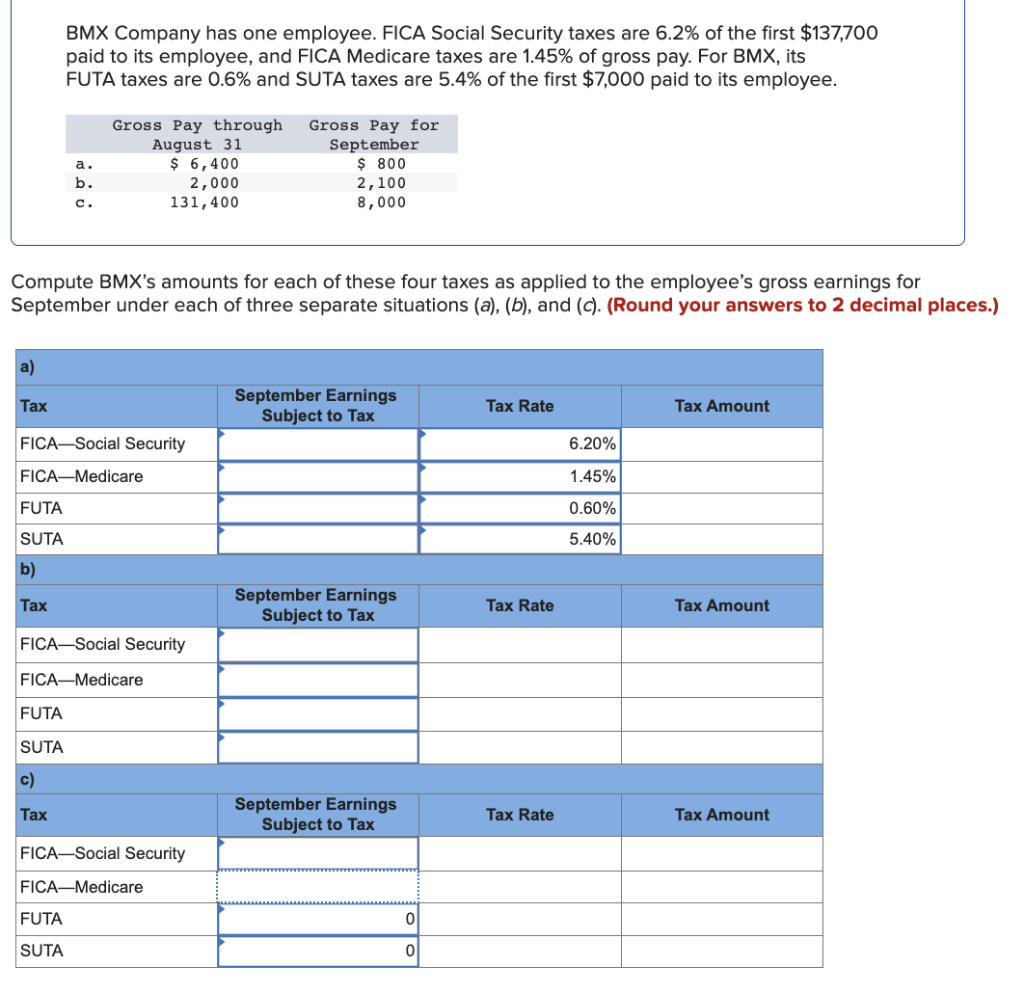

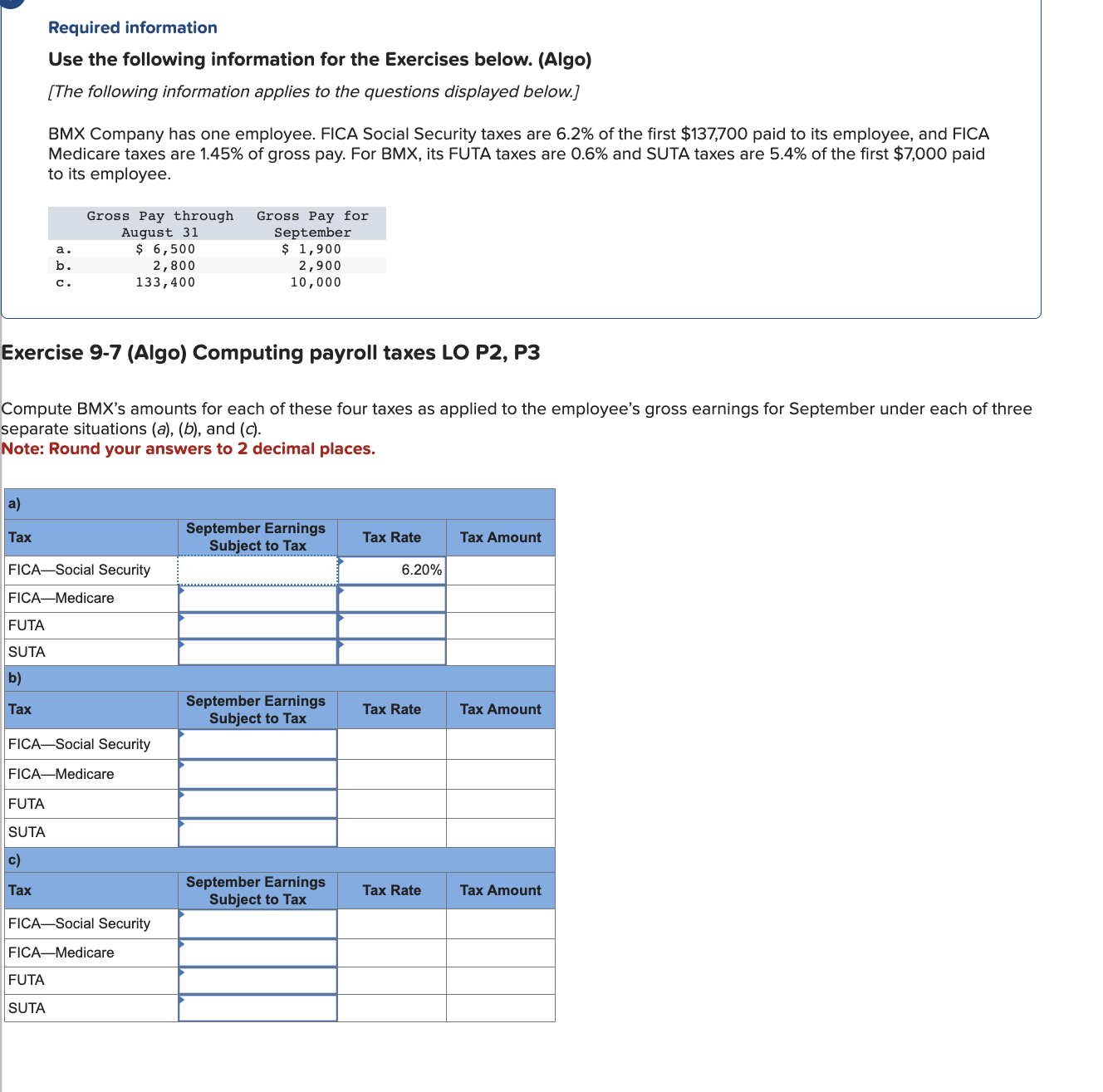

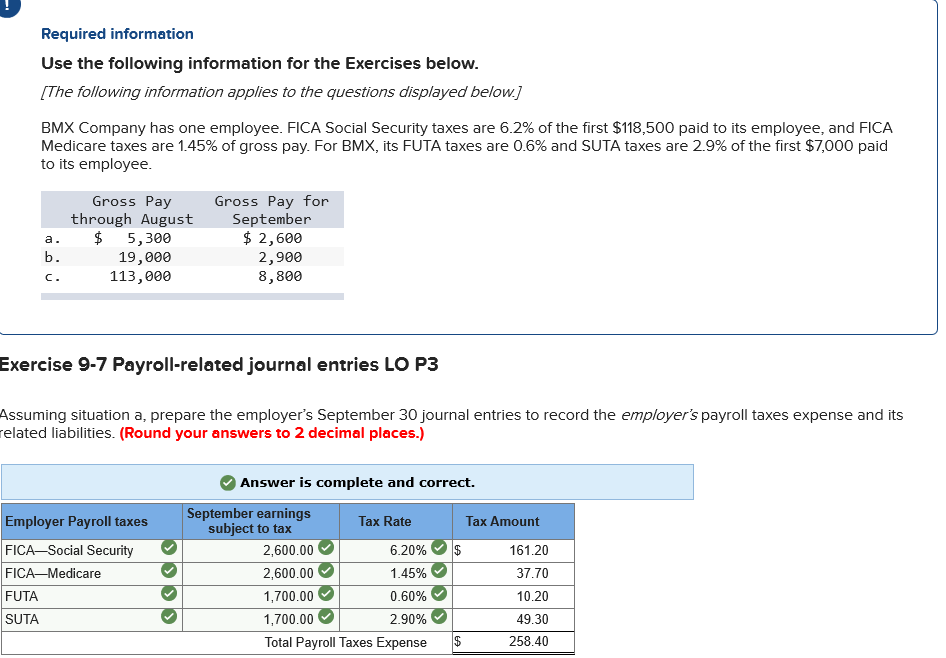

Employer Fica And Medicare Rates 2025. For 2025, an employer must withhold: Social security and medicare tax rates:

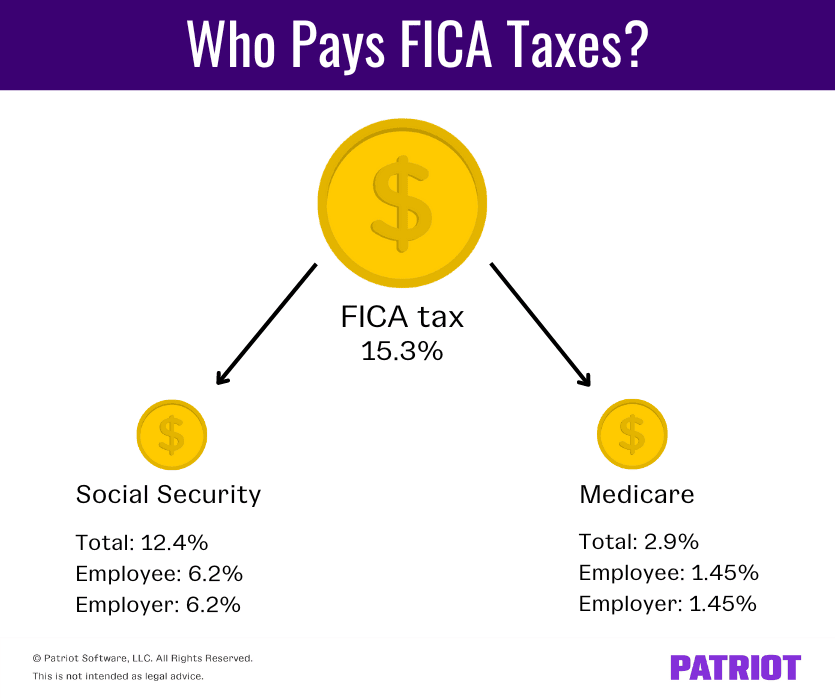

The total fica tax is the sum of the social security and medicare taxes. The social security tax rate is 12.4% of the employee’s gross income, up to a certain income limit.

Employer Fica And Medicare Rates 2025 Images References :

Source: lorrainekaiser.pages.dev

Source: lorrainekaiser.pages.dev

Employer Fica And Medicare Rates 2025 Ny Nancy Valerie, This tax is 1.45% for the employee and 1.45% for the employer, totaling 2.9% of earned wages.

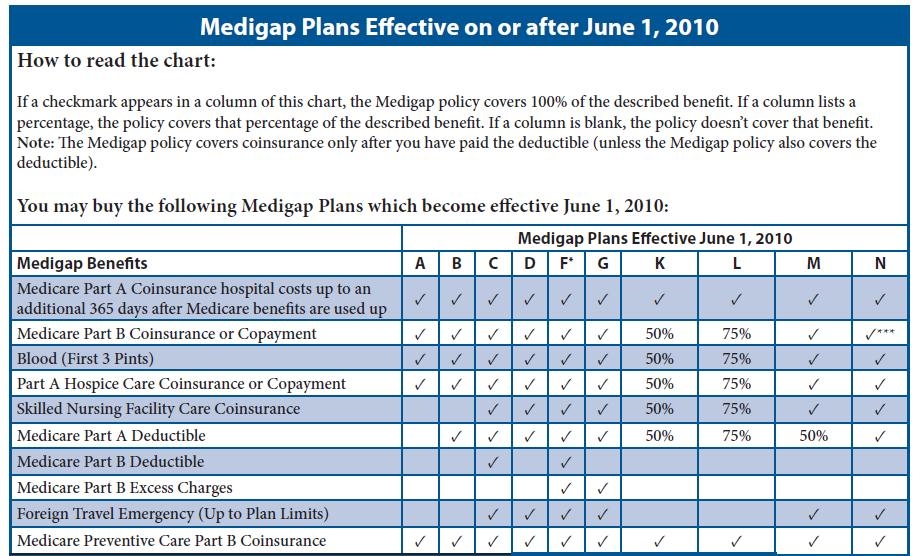

Source: www.medicaretalk.net

Source: www.medicaretalk.net

How To Calculate Medicare Wages, Social security and medicare tax rates:

Source: inezcallihan.pages.dev

Source: inezcallihan.pages.dev

How To Calculate Fica Tax 2025 Hallie Laurie, There is an additional 0.9% surtax on top of the standard 1.45% medicare tax for those who earn over $200,000.

Source: joshuahutton.pages.dev

Source: joshuahutton.pages.dev

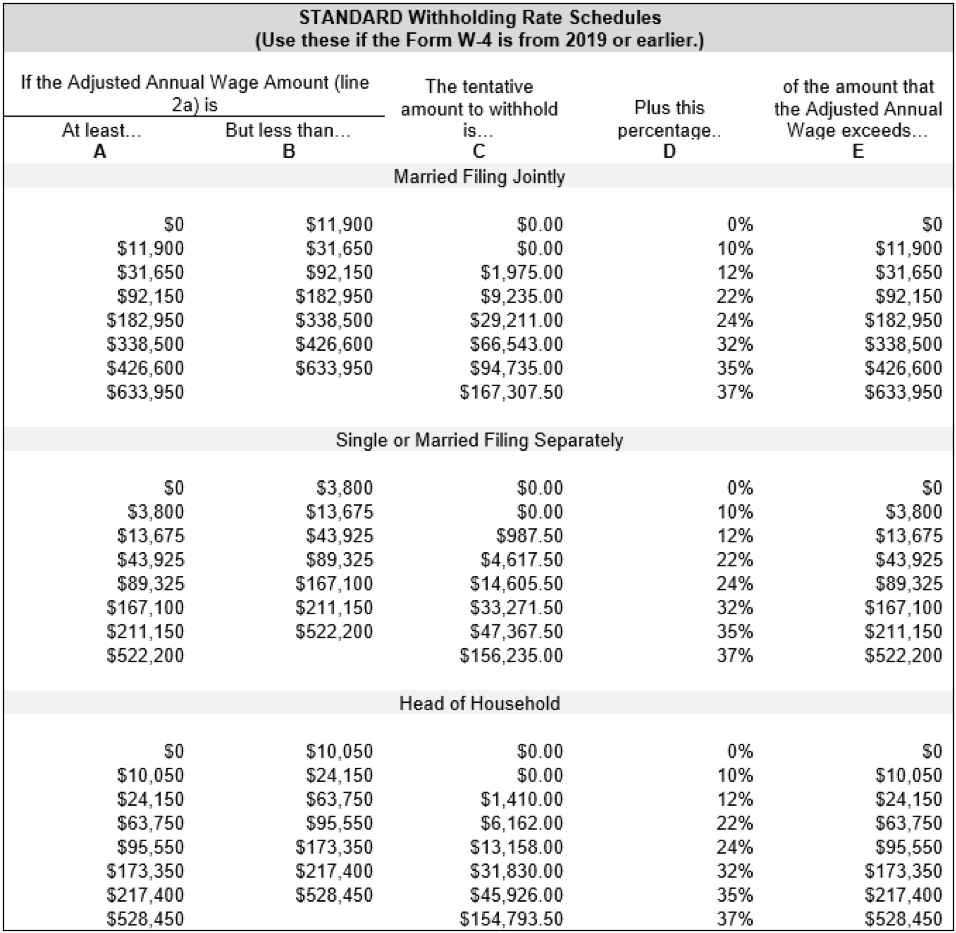

Tax Withholding Tables 2025 Angele Lauree, For 2025, the irs has set the fica limit at $160,200.

Source: mployerta.blogspot.com

Source: mployerta.blogspot.com

Employee And Employer Taxes MPLOYERTA, The social security wage base has increased from $160,200 to $168,600 for 2025, which increases the maximum individual contribution by 5.2%.

Source: www.finansdirekt24.se

Source: www.finansdirekt24.se

Who Pays Payroll Taxes? Employer, Employee, or Both? (+ Cheatsheet, In 2025, the social security tax rate is 6.2% for employers and.

Source: lorrainekaiser.pages.dev

Source: lorrainekaiser.pages.dev

Social Security Distribution Calendar Vanna Jannelle, 6.2% social security tax on the first $168,600 of employee wages (maximum tax is $10,453.20;

Source: www.chegg.com

Source: www.chegg.com

Solved BMX Company has one employee. FICA Social Security, 6.2% for the employee plus 6.2% for the employer.

Source: www.chegg.com

Source: www.chegg.com

Solved BMX Company has one employee. FICA Social Security, The 2025 medicare tax rate is 2.9%.

Source: www.chegg.com

Source: www.chegg.com

Solved Required information Use the following information, For 2025, the irs has set the fica limit at $160,200.

Category: 2025